Global gas oversupply unlikely to shut in US LNG — but Henry Hub prices might

Price-sensitive demand is likely to absorb medium-term oversupply. The bigger threat to US LNG utilization is a cold winter and $5+ Henry Hub.

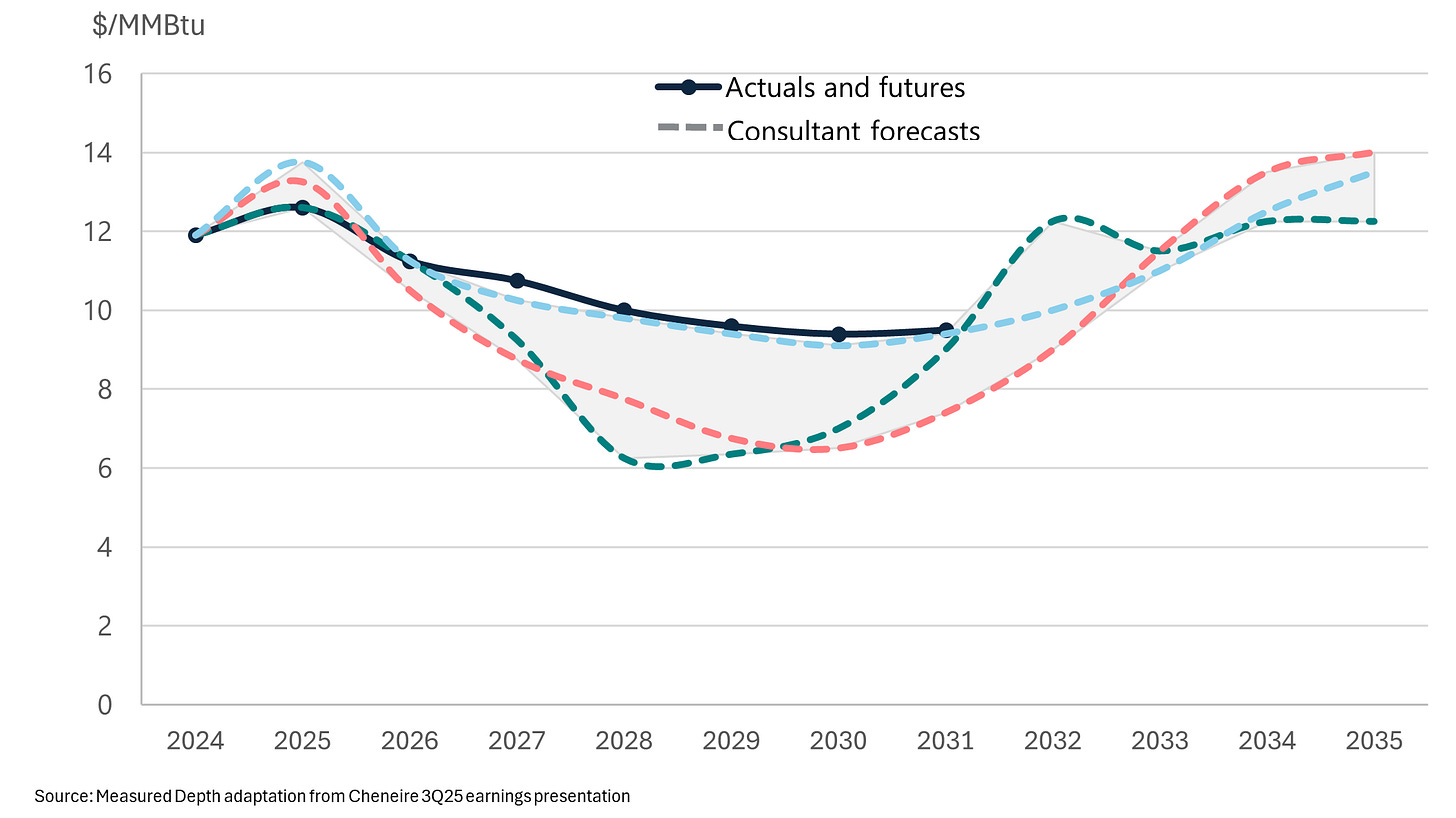

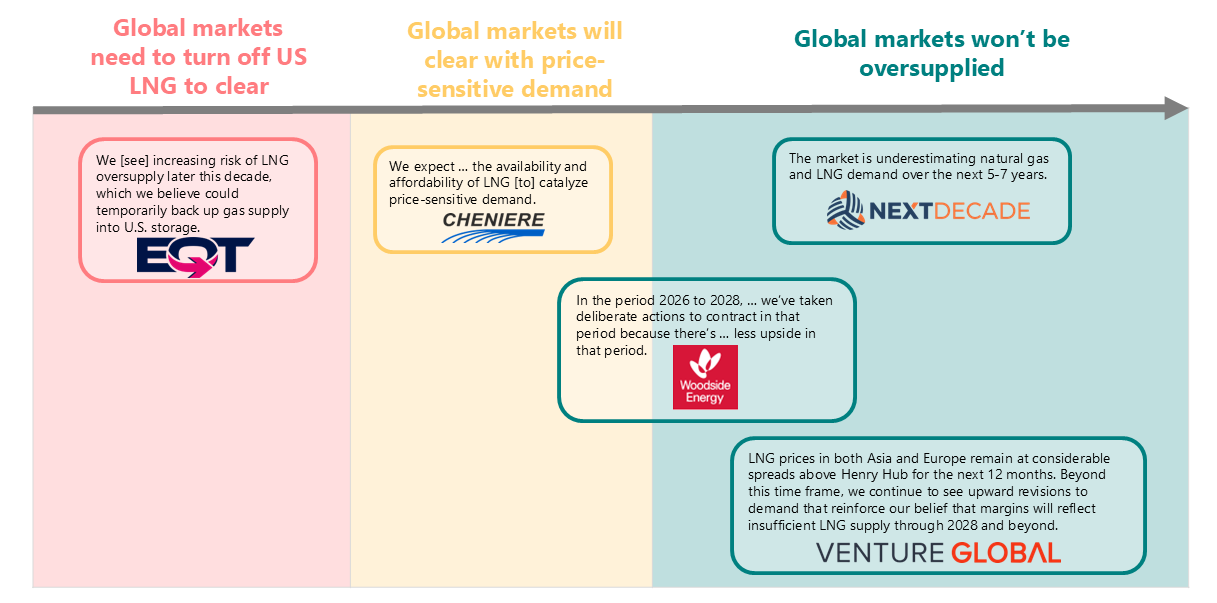

Despite a surge in US LNG FIDs this year, companies struck markedly different tones during their recent earnings calls. With new projects stacking up, investors are asking whether US LNG economics can hold as global prices fall. Analysts broadly expect medium-term oversupply, as Cheniere explicitly highlighted in its 3Q earnings presentation. But the question for US LNG isn’t whether global prices dip to $7-9/MMBtu. It’s whether they fall low enough to shut in US exports — and history suggests they won’t. Instead, the scenario most likely to reduce US LNG utilization comes from the opposite direction: tightness in the North American market.

Figure 1 | Consultant global gas price outlooks

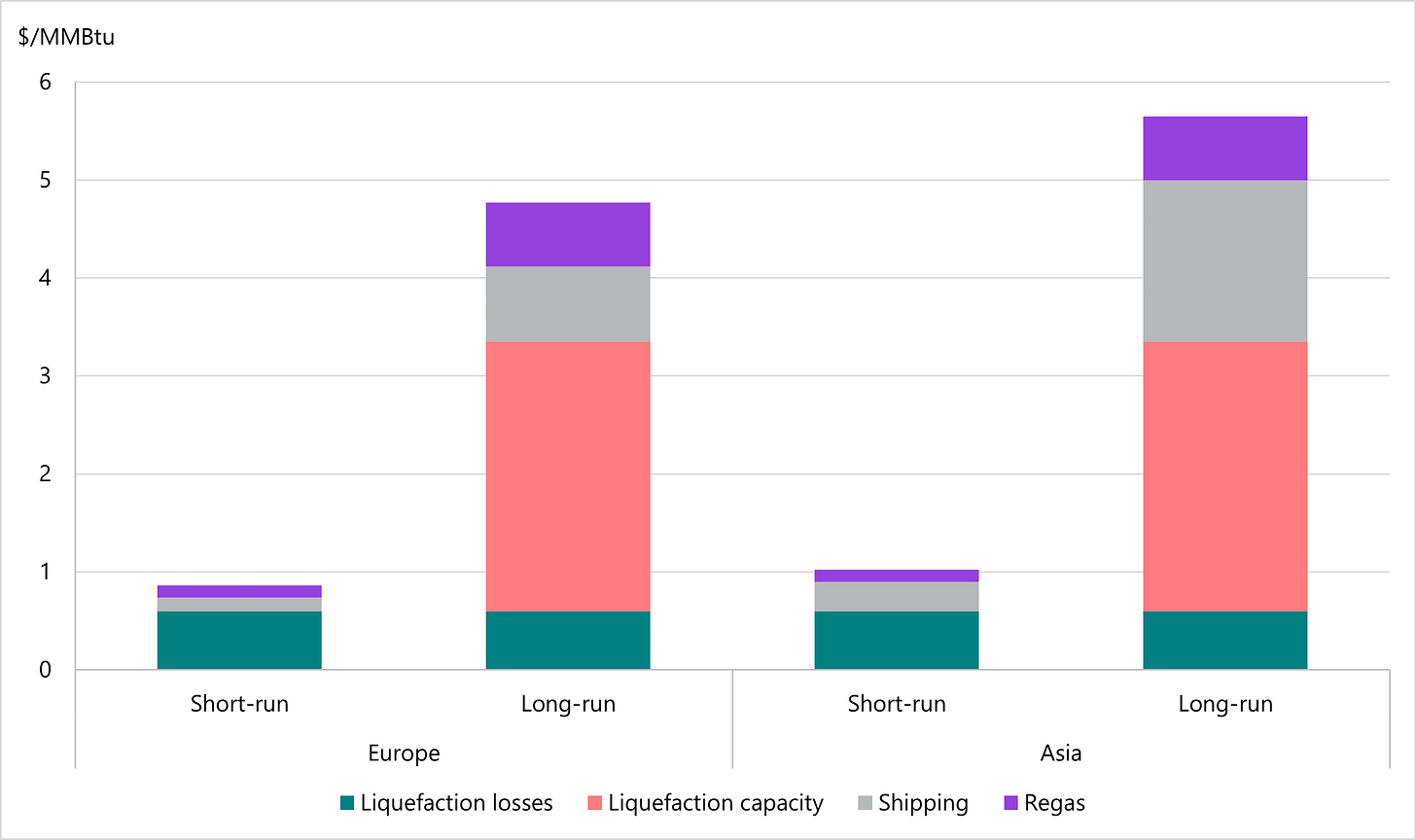

Margins needed for utilization are much lower

But while global prices sustained at the level consultants expect would present an enormous headwind to US LNG profitability, the short-run costs of operating US LNG export capacity are significantly lower, in the $0.75-1.00/MMBtu range, driven mainly by the 15% liquefaction margin.1 Aside from a brief pandemic period of sub-$1/MMBtu speads, US LNG export capacity has been fully utilized.

Figure 2 | US Gulf Coast LNG cost structure

More than 15 Bcfd of US LNG moves to other markets worldwide, but the North American market remains isolated. For now, if European or Asian prices rise or fall by $2/MMBtu, it impacts the profitability of US LNG exports but has no effect on the volume of US LNG exported. US LNG export capacity is, in practice, baseload domestic demand, with utilization primarily affected by operational outages2 or weather events that disrupt seaborne shipping.

However, some consultants and investors now expect the TTF–Henry Hub spread to fall below this $1/MMBtu threshold, thereby clearing the global LNG market by curbing US exports. This view, alongside more supportive demand and more bullish structural theses, defines three medium-term schools of thought.

Figure 3 | Three schools of thought on medium-term LNG markets

Since earnings season began, market movements have supported a more bearish outlook, with the January TTF contract trading down from the mid-$10/MMBtu range to ~$9.25 currently. Historic data also supports Cheniere’s view that price-sensitive demand is likely to emerge.

How low do prices need to be to catalyze demand?

As has occurred in the US domestic market over the last 15 years, a shift away from coal in power generation is the most likely source of upside in LNG demand. And LNG prices do not need to fall as low as coal prices to see that demand upside because:

Gas CCs are more efficient than coal plants

Even middle-income countries will pay a modest premium to cut particulate emissions3

Historically, we find that LNG demand accelerates when LNG prices are within $1-2/MMBtu of coal prices. Only in the pandemic did the spread between TTF and Newcastle coal narrow to less than $0.90/MMBtu annually. Currently, delivered high-spec coal prices are ~$5/MMBtu, suggesting LNG demand growth accelerates at ~$6-7/MMBtu.

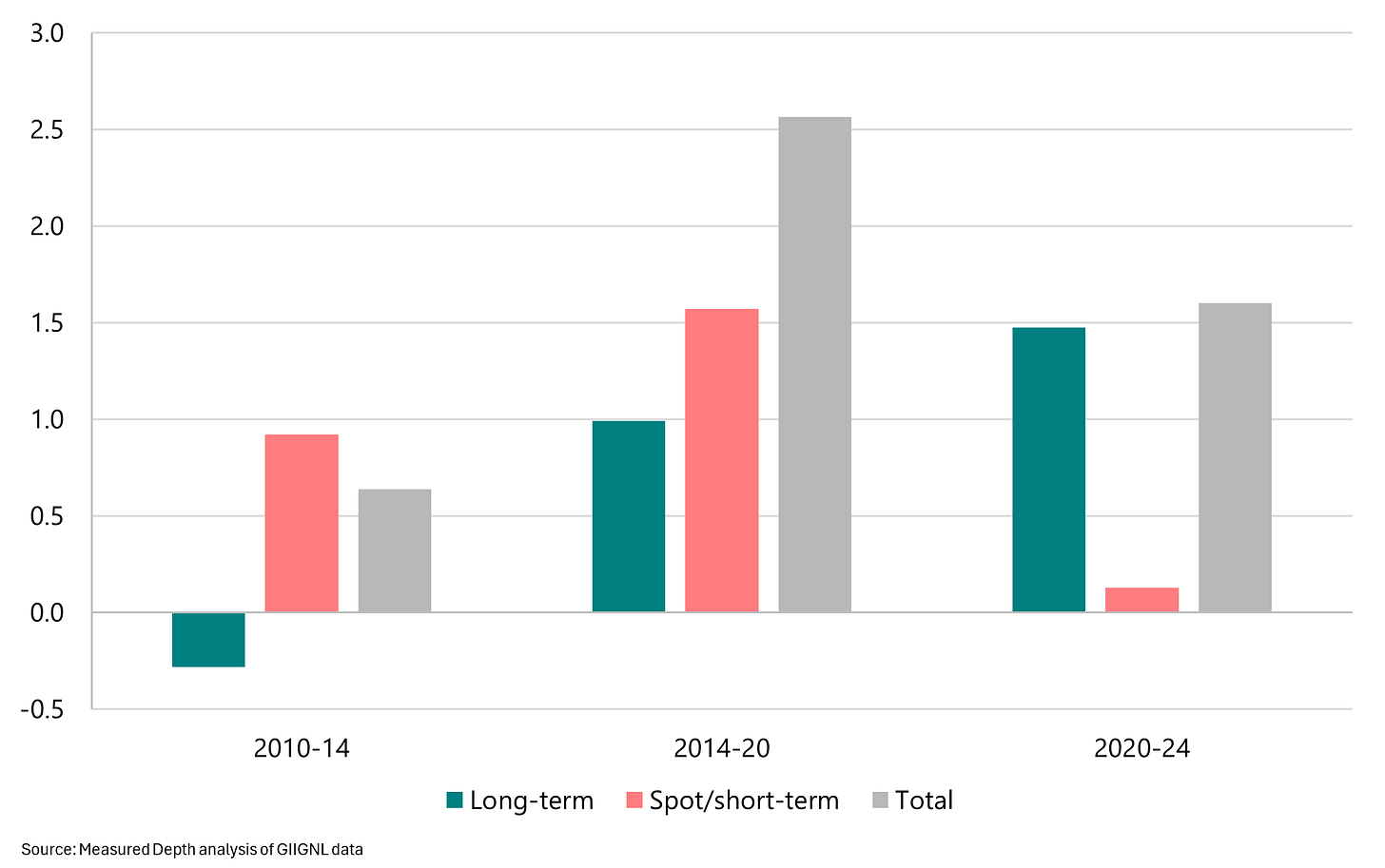

How much LNG demand is added with low prices?

Following the Fukushima Daiichi nuclear disaster, global LNG markets tightened, and European prices averaged ~$9.30/MMBtu in 2011-14. US liquefaction later rebalanced the LNG market, pushing European prices down to ~$5.40/MMBtu4 in 2015-20. These lower prices, in turn, accelerated coal displacement, and spot LNG purchases added 1.5 Bcfd of annual demand growth. With the regas buildout since then, 2.0-2.5 Bcfd of price-sensitive annual demand growth is plausible now. This displacement is equivalent to ~0.5% of the coal burned in Asia.

In short, falling LNG prices are likely to increase LNG demand before prices are low enough to shut off US LNG supply. That means North American prices stay disconnected from global markets even as US LNG exporters’ margins decline. For oversupply to reduce US LNG utilization, the global economy needs to be so weak as to cut power generation and push seaborne coal, and therefore LNG, prices down.

Figure 4 | LNG demand growth by type

Recent years show the opposite: TTF prices averaged ~$18/MMBtu, and spot demand grew only ~100 MMcfd annually, highlighting that LNG demand growth is unlikely to be strong while prices are high.

What about liquefaction delays?

Several developers justified their bullish view on US LNG by citing likely project delays. But only catastrophic delays or cancelations could rebalance a market this oversupplied. North American liquefaction adds ~3 Bcfd annually over the 2026-30 period, with another ~2 Bcfd due online elsewhere,5 versus a typical ~2 Bcfd global liquefaction growth pace.

And while some slippage in in-service dates is likely, the overbuild is so severe and prolonged that delays alone cannot balance the market on a sustained basis. If Project A slips from year N to year N+1, then liquefaction capacity grows strongly in year N+1, even if a comparable project scheduled for year N+1 is also delayed.

How Henry Hub prices play into this

But LNG shut-ins are likely to happen for another reason: balancing the US market during periods of temporary supply shortfall. US storage capacity is largely unchanged from 15 years ago, whereas demand is 60% higher. Relative to the 2010s, supply is less elastic in this era of capital discipline, and demand is less elastic now that so much coal capacity has been retired.

A mild winter can still send Henry Hub prices crashing to sub-$2/MMBtu, with the market clearing through upstream shut-ins. But so too can a cold winter send Henry Hub prices skyrocketing upward. When global LNG prices are in the teens, as in 2021-22, upside to Henry Hub prices is capped by US storage drawdowns. But if TTF is trading at $6.50/MMBtu, then ~$5.50/MMBtu becomes an LNG-based ceiling for Henry.

This winter shows signs of how that scenario could play out, even if briefly. While the January TTF contract has sold off by ~$1.50/MMBtu since earnings season, January Henry Hub traded as high as ~$5.50. Milder forecasts this week pushed US prices back down, but a cold January week could briefly leave US LNG underwater even on a variable-cost basis.

Operator implications

So the real US LNG utilization risk doesn’t come from weak global prices. It comes from a strong domestic market, pushing Henry prices to the TTF ceiling. And that dynamic reshapes who wins and who loses.

US E&Ps without LNG exposure would be the clearest winners. Higher Henry Hub prices directly lift their earnings, with no offsetting losses on liquefaction. EQT would also benefit, as the upside from domestic gas sales would substantially outweigh LNG losses. Developers with little commodity exposure, such as Cheniere and NextDecade,6 are largely insulated.

Most exposed are the LNG developers and offtakers that are short Henry Hub against TTF length. Woodside and Sempra acknowledged the need for additional third-party contracting at Louisiana LNG and Port Arthur Phase 2, and the urgency increases as spreads narrow. Venture Global’s Plaquemines and CP2 are contracted, but the company’s business model depends on profits from pre-commercial cargoes. In its 3Q call, Venture Global cited economics for this LNG under two price scenarios,7 but the 2026-28 spread is already ~$0.40/MMBtu narrower than the weaker case.

And that’s before the worst of the LNG glut has even arrived. Yes, US LNG offtakers enjoyed an incredible first 10 years, buoyed first by Fukushima and then by Russia’s invasion of Ukraine. But already, cracks are emerging, and companies retaining TTF-Henry exposure are likely to be left holding a very big bag.

Typically, liquefaction losses are in the 8-9% range, but the vast majority of US LNG contracts are FOB, with the capacityholder paying the LNG developer 115% of Henry Hub for any cargoes lifted

Either planned, like maintenance, or unplanned, such as equipment failures

Reducing particulate emissions enjoys much stronger support than CO2, as it principally has local air-quality benefits rather than a diffuse global impact

I cite European prices here partly because price-sensitive LNG buying emerged there but also because TTF is the most liquid LNG hub and therefore also a reasonable proxy for prices facing Asian buyers

Excluding any growth from geopolitically challenging projects in Russia and Mozambique

NextDecade expressed more optimism about the global market, but its recent FIDs were still underpinned by third-party contracts

Technically, implied liquefaction fees, but effectively the TTF-Henry spread